Tight Interest Rate Outlook…60% Expect "Three Consecutive Cuts" vs 40% "Hold"

Korea Economic Daily Economist Club Survey

More than half of the economic experts in the Korea Economic Daily Economist Club predict that the Bank of Korea will cut the current base rate of 3.0% by 0.25 percentage points at the Monetary Policy Committee meeting on the 16th. This is due to concerns about economic sluggishness. However, there is also a strong opinion that the rate will be held steady considering the instability of the won-dollar exchange rate.

60% “Lower Rates to Stimulate Economy”

On the 13th, a survey of 20 economic experts from the Korea Economic Daily Economist Club showed that 12 (60%) expect the Bank of Korea to operate monetary policy by lowering the base rate by 0.25 percentage points to 2.75% at the January Monetary Policy Committee meeting.

Experts predicting a rate cut cited the need to respond to economic sluggishness. Kathleen Oh, Chief Economist at Morgan Stanley Korea, said, “The Bank of Korea will see increased downward pressure on the economy due to martial law and the aircraft accident,” adding, “As price stability is expected to continue, there is a high possibility of further rate cuts to boost the economy.”

Namgang Lee, an economist at Korea Investment & Securities, explained, “Demand pressure could quickly deteriorate due to the shock of political uncertainty,” and “a base rate cut is needed to prevent further weakening of consumer sentiment.”

There was also an opinion that monetary policy is the only means for economic recovery. Min Ji-hee, a bond analyst at Mirae Asset Securities, pointed out, “The ability to mobilize fiscal policy is limited due to the political stalemate,” and “the need to further lower rates has increased.” Ha Geon-hyeong, an economist at Shinhan Investment Corp., added, “Monetary policy will fill the gap of expansionary fiscal policy.”

40% “Exchange Rate Instability, Need to Hold”

Eight (40%) expressed the opinion that the base rate should be maintained at the current level of 3.0%. They were particularly concerned that exchange rate instability could stimulate inflation. Shin Kwan-ho, a professor of economics at Korea University, predicted, “Exchange rate stability is needed to maintain external credibility,” and “the Bank of Korea will keep the rate at 3.0%.” Kim Sang-hoon, head of research at KB Securities, pointed out, “Exchange rate instability could cause inflation to rebound.”

The won-dollar exchange rate surged sharply after President Yoon Seok-yeol declared martial law last month. It has been moving in the range of 1,450 to 1,470 won this month. In this situation, if the Bank of Korea lowers the rate, the interest rate gap with the U.S. could widen, potentially pushing the exchange rate further to 1,500 won, according to these experts.

The delay in the U.S. interest rate cut schedule was also cited as a factor making it difficult to lower rates. Lee Yoon-soo, a professor of economics at Sogang University, said, “Consideration of the U.S. monetary policy stance change is necessary.” Kim Hyung-joo, head of the economic policy division at LG Economic Research Institute, also mentioned the “possibility of a delay in U.S. rate cuts.”

On the 10th (local time), the U.S. employment figures significantly exceeded market expectations, greatly dampening expectations for a rate cut. The possibility of inflation re-emerging with the inauguration of the Trump administration is also being raised. At the end of last year, the U.S. Federal Reserve reduced its forecast for rate cuts this year from four to two, but the market is predicting even fewer cuts.

There was also an opinion that three consecutive rate cuts would be burdensome. The Bank of Korea already implemented two consecutive rate cuts in October and November last year. Lee Seung-heon, former vice governor of the Bank of Korea (professor at Soongsil University Graduate School of Business), viewed, “Three consecutive cuts could negatively affect economic sentiment.” This means that excessively rapid rate cuts could be interpreted as the economy deteriorating that much.

In this interest rate outlook, the opinions of bond market experts and professors and researchers were starkly divided. Among 11 bond market experts, 9 (81.8%) predicted a rate cut, while among 9 professors and researchers, 6 (66.7%) expected the rate to hold.

Two to Three Rate Cuts Expected This Year

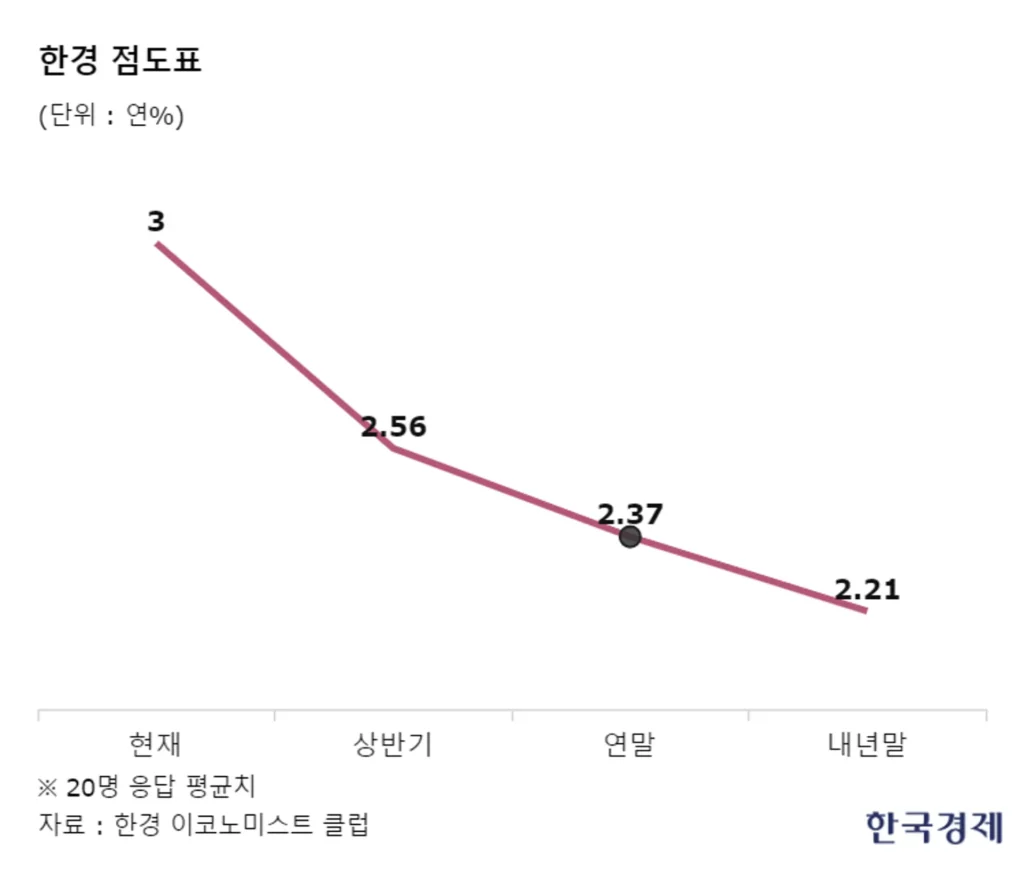

Experts from the Korea Economic Daily Economist Club expect the Bank of Korea to cut the base rate two to three times this year. The average rate level they suggested was 2.56% in the first half and 2.37% by the end of the year.

Of the 20 respondents, 9 (45%) expressed the opinion that the base rate would be cut twice by 0.25 percentage points each to 2.5% by the end of the year. Eight (40%) suggested 2.25% as the year-end rate. The opinion that it would be cut four times to 2.0% (2 people, 10%) appeared for the first time.

The average rate forecast for the end of next year fell to 2.21%. Half of the respondents predicted it would fall to 2.25%. Seven experts (35%) expected the monetary policy to operate at 2.0% after four cuts.

Kang Jin-kyu, reporter [email protected]